The Quickest Way for Funds to Get Quality Data: Meet NewtonX Prime

Many hedge funds and private equity firms today are being sorely challenged by economic and market volatility. The leading firms are using new technology to maintain their edge, and those without it risk falling behind.

Nearly 97 percent of US hedge funds underperform their benchmarks, according to S&P. In private equity, spiking interest rates in the second half of 2022 caused a sharp decline in deals, exits, and fund-raising, according to Bain & Co. And venture capital is still coping with the 2022 retrenchment in the tech sector, which saw deal flow drop by a quarter between the first and fourth quarter of that year, Pitchbook reports.

In order to outperform in these volatile markets and drive consistent returns for investors, fund managers need to be able to separate signals from noise quickly to understand business fundamentals. But it has always been challenging to acquire high quality knowledge to quickly and confidently test investment theses.

NewtonX Prime is a novel way to achieve knowledge goals in real time. It is the first on-demand competitive intelligence platform to combine data from expert interviews and expert surveys. Our tool delivers the perfect combination of speed and certainty, delivering the edge you need to beat the market.

In this article we will examine these challenges, and the way NewtonX Prime helps funds overcome them, including:

- Achieving a key research goal for investment/portfolio managers and CIOs: acquiring actionable, quality information quickly. As participants in a recent webinar co-hosted by NewtonX and Hedgeweek explained, this can be seen as seeking a return on time

- How investors use research to achieve their goals, and how these processes can be made faster and more efficient

- Why old-school approaches to achieving the goals are slow and inefficient

- How NewtonX Prime overcomes these approaches

A key research goal for investors: boosting “return on time”

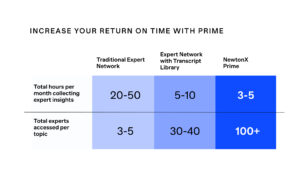

Achieving real-time analysis is key, both at scale and at speed. Analysts and investors choose NewtonX Prime because it delivers the largest number of expert opinions on any topic in a matter of seconds.

Competitive industry-leading primary research is at the core of NewtonX. Our proprietary AI technology aggregates and analyzes hundreds of interviews and thousands of survey responses to deliver the highest quality expertise in the world.

Prime’s data saves over 10 times the time necessary to gather research and boosts the potential return on the time invested in research.

The old-school approach to research — slow and inefficient

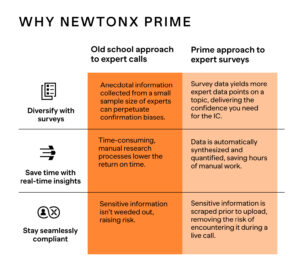

In the past, investors had to rely on expert networks for qualitative interviews. This had a number of problems:

- Anecdotal information collected from too few sources who might not be ideal experts or who might perpetuate confirmation biases

- It is extremely time-consuming. If time is the denominator of return on time, longer research processes lower the return on time

- Using traditional research firms that do not have broad access to validated experts available in real-time can result in poor or biased information, and data that might miss insightful opinions by reflecting only the herd view

Prime’s approach to research — fast and comprehensive

Prime delivers the largest number of expert opinions on any topic in a matter of seconds; a combination unmatched by today’s competition.

With industry-leading primary research at the core of NewtonX, the NewtonX Prime platform aggregates and analyzes hundreds of interviews and thousands of survey questions to deliver the highest quality expertise in the world.

Boost your return on time, starting today

Test drive the first on-demand competitive intelligence platform to combine data from expert interviews and expert surveys. Our tool delivers the perfect combination of speed and certainty, delivering the edge you need to beat the market, and reliably improve your fund’s return on time.

Click here to book a demo today.

Sign up for our newsletter, NewtonX Insights:

Related Content

[Webinar] Searching for Knowledge: How hedge funds can find the right ‘experts’ and enhance returns

Join Hedgeweek and NewtonX for an insightful webinar as we reveal how finding the right 'experts' can help decision making and enhance your fund's returns.

read moreThe next generation of insights for hedge funds

Hedge funds require prescient and contrarian perspectives to outperform the market and deliver positive results to investors. To ensure high returns from volatile markets, equity investors require accurate data from end-to-end research services. It is

read moreHow a hedge fund identified contrarian responses and risks missed by expert calls

Our targeted surveys helped a leading hedge fund reach more professionals and discover contrarian insights that earlier 1:1 consultations couldn’t deliver.

read more

NewtonX Appoints Kavita Anand as VP of Product

New York, NY, March 21, 2024 – NewtonX, a leading provider of B2B market research, is proud to announce the appointment of Kavita Anand as its new Vice President of Product. From the NewtonX Knowledge

read more

Hedgeweek: Building reliable research by scaling qualitative data

Solid findings from reputable sources can validate an investment thesis while vague information from weak experts risks wasting time and money while potentially leading a manager to a dead end.

read more