[Report] How Brand Impacts Share Price

Interbrand, NewtonX, and Brodeur Partners reveal how brand research and investor communications can improve company valuation.

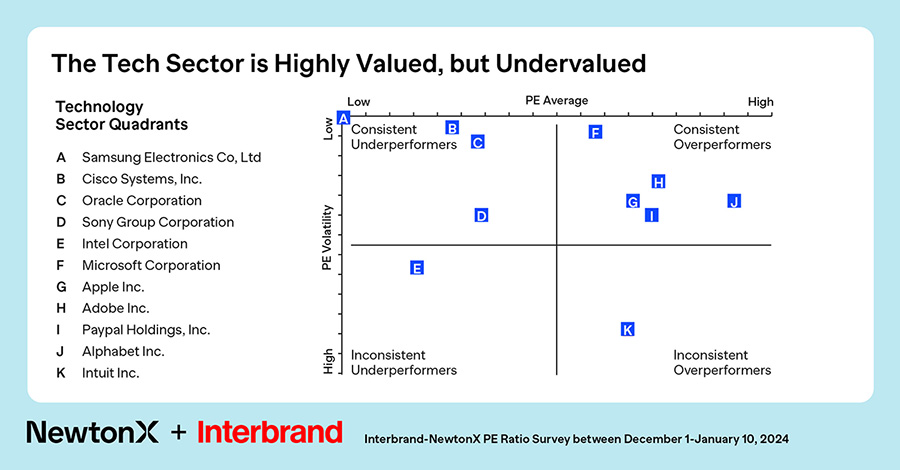

Brand isn’t just a company asset. It’s a critical determinant of a company’s market success. Yet new research by Interbrand and NewtonX reveals that 67% of brands struggle to fully reflect their strength in share prices and are currently underperforming their competitive set.

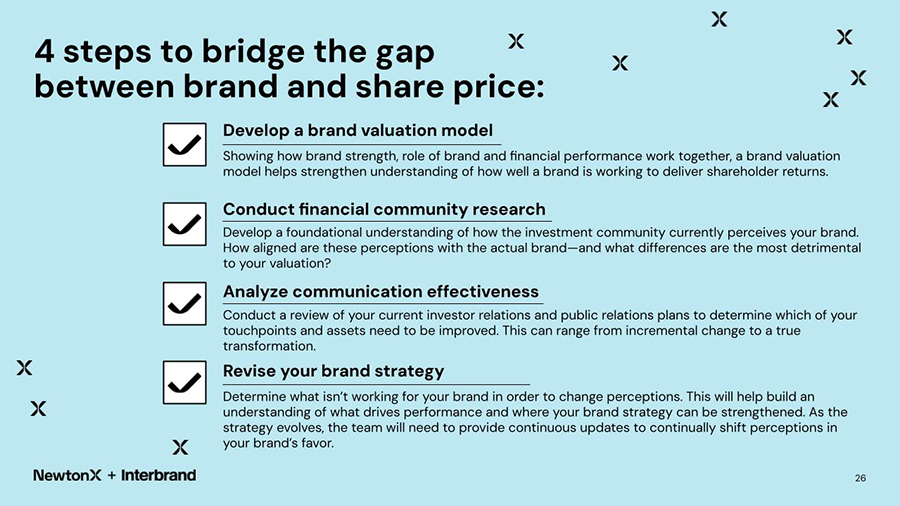

Through analyzing P/E ratios and primary research within the investment community, we’ve identified a powerful driver that can shift the balance, change investor understanding, and bring earned value back to a company’s share price. Best of all, it’s an asset that companies already have the power to strengthen: their brand.

We’ve published a report, How Brand Impacts Share Price, to show you how to connect brand, investor communications and advanced AI-based research.

Download the report here.

Preview the data and takeaways below:

Sign up for our newsletter, NewtonX Insights:

Related Content

How to Influence the CEO’s Agenda with Brand Research

Join Interbrand and NewtonX to learn how insights leaders can use primary and public data to connect brand strategy and brand value.

read more

New Research Finds a Powerful Connection Between Brand and Share Price

Originally published on PRNewswire, March 20, 2024. NEW YORK, March 20, 2024 /PRNewswire/ — New research released today by Interbrand, in partnership with NewtonX and Brodeur Partners, unveils a powerful connection between brand and share price. The report, How

read moreAdweek + NewtonX Quantify the Business Impact of CMO Collaboration

What separates great CMOs from good ones? NewtonX and Adweek reveal the skills, behaviors and attributes of great CMO collaborators.

read moreHow Interbrand unlocked market capitalization with brand research

67% of S&P 500 companies may be inaccurately valued due to brand understanding. For enterprise research leaders looking to influence C-suite strategy, realigning investor understanding of your brand can help.

read more