How to Influence the CEO’s Agenda with Brand Research

Interbrand and NewtonX reveal how insights leaders can use primary and public data to connect brand strategy and brand value.

Jackie Cutrone: Hi, everyone. Thanks for joining us. I’m Jackie Cutrone, CMO at NewtonX. If NewtonX is new to you, we are the leader in B2B research. We built the most sophisticated algorithm in the industry to connect enterprises to the exact professionals they need to make better decisions.

At NewtonX, I lead efforts to spotlight clients who are doing B2B research really well, so research and insights leaders like yourselves can learn from your peers. With that, I am very excited to be here with Greg.

Greg Silverman: I’m Greg, Global Director of Brand Economics at Interbrand. I lead projects on M&A, brand strategy, product launch, brand architecture, CX, brand valuations, and go-to-market for our global clients.

Interbrand is the world’s leading brand consultancy, for 50 years – having pioneered iconic work and forged many of the brand building tools that are now commonplace.

Starting with a quick pulse check – we have a couple questions for you.

- First off – Did you ever consider that research could change your company’s share price?

- Now – What are you hoping to learn in this session? You can drop this in the chat.

Greg: This story starts with insurance.

We were working with a global insurance client. We told them that investment analysts didn’t understand their business. They asked us to prove it, we went out and did our research, and what we found was – they were associated with retirement planning.

They laughed. They sold off the retirement business years ago. And that was the first break in the dam. That was where research picked up on the simplest thing that got overlooked. It crystallized our hypothesis.

Now, insurance is a fulcrum for the larger story.

Backing out to the industry level – there are lots of new entrants into the market due to private equity groups buying insurance companies to get access to the capital.

When you see the multiples that these companies are getting, versus the incumbents – there’s a wide disparity. New entrants were being valued at 2x the value of incumbents, even when their financial performance was the same.

So we sat and listened to investor calls. They’re all talking about capital ratios, regulatory compliance, money needed on hand.

Nobody mentioned brand, relationships with customers, futureproofing the business. All these things that are marketed to the investor and consumer didn’t show up in actual investors relations calls. The CFO and CEO weren’t talking about it.

Yet those were the things the new entrants talked about, because they didn’t have the track record of incumbents.

Here’s two extremely well known brands to exemplify the broader issue – Apple and Meta are some of the highest valued brands, and even they don’t highlight that strength in investor communications. It pointed to a gap and an opportunity.

This yielded a simple observation: business growth and earnings potential aren’t always reflected in a company’s public share price.

We wanted to verify how this hypothesis worked with the investment community—and wanted to hear it straight from the horse’s mouth, so we called NewtonX.

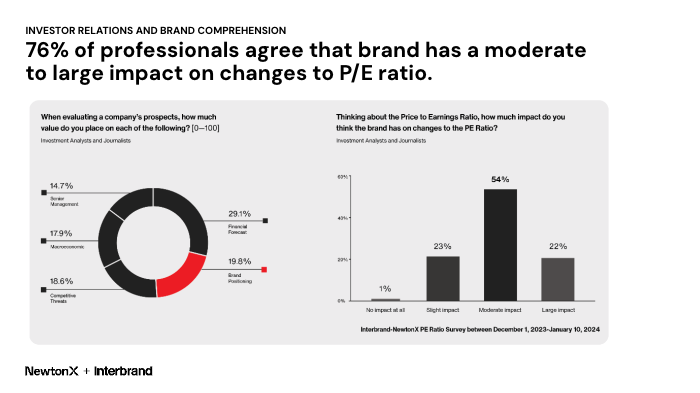

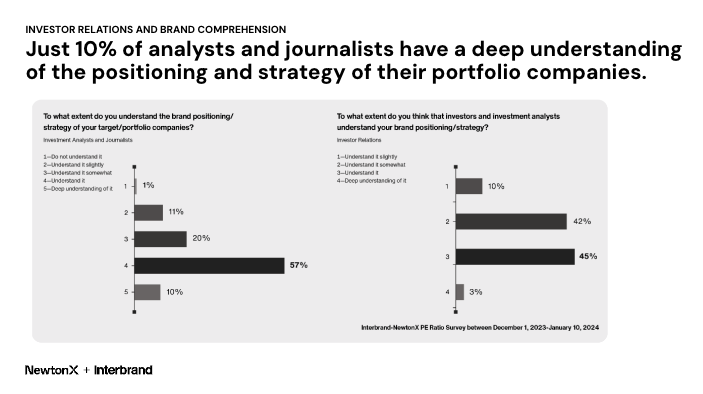

Jackie will dig into the research more later, but we found that 76% of investment analysts and journalists agree that brand has a meaningful impact on valuation. Yet 90% don’t have a deep understanding of brand – the second most important thing to valuing a company after financials.

Applied to our insurance client – that’s where Interbrand comes in. We consult our clients on how to effectively tell their stories. Plus, it doesn’t hurt when they have a 150 year head start over new entrants.

So, after we did some qual and realized that analysts weren’t considering the totality of the brand in the story, we thought, well, why don’t we take a look at P/E ratios as an expression of future earnings?

We ran the numbers and found that 67% of companies in the S&P 500 may be inaccurately valued due to the misunderstanding of one key business asset: brand.

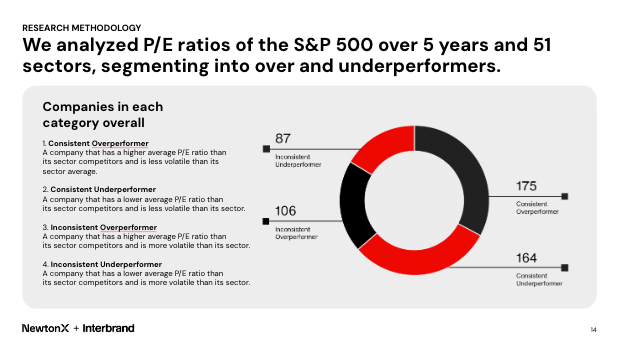

Our methodology: We developed a data set consisting of U.S. publicly traded S&P 500 companies and the Interbrand Best Global Brands 2023 cohort that wasn’t already included in the S&P.

We then analyzed the P/E ratio of each company over the past five years (2019 – 2023).

We started with the last 20 years but that gave us the sensibility that they weren’t relevant – there were too many systematic changes that contributed to volatility, so we narrowed down to 5 years.

Then we compared the performance of brands in every sector that were consistently valued and had low volatility – that was 1/3 of the group. That’s what you want in a stock. That left us with 2/3 of the market that were inaccurately valued – that had wild swings in volatility and absolute values.

Through this analysis, we were able to segment company outcomes into overperformers and underperformers. (You can do this research with your own company too – to figure out, how well is your brand understood by the investment community?)

This furthered the hypothesis that analysts don’t get it. In our data – values were increasing, and brands were performing better – but the slope in share price was flatter than increase in brand value. Measuring share price health alongside brand health – those two should be moving at the same rate.

Ok, so someone’s missing something. There was a broken piece in the chain.

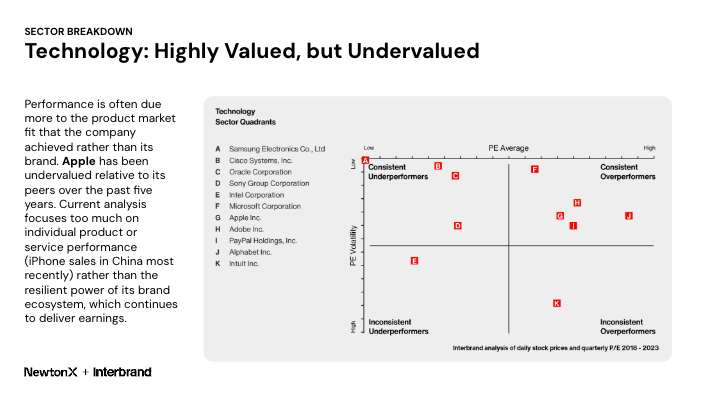

This clarifies when we break it down by industry. For example, in the technology sector we find that brands are highly valued, but undervalued.

Performance is often due more to the product market fit that the company achieved rather than its brand. Apple has been undervalued relative to its peers over the past five years. Current analysis focuses too much on individual product or service performance (iPhone sales in China most recently) rather than the resilient power of its brand ecosystem, which continues to deliver earnings.

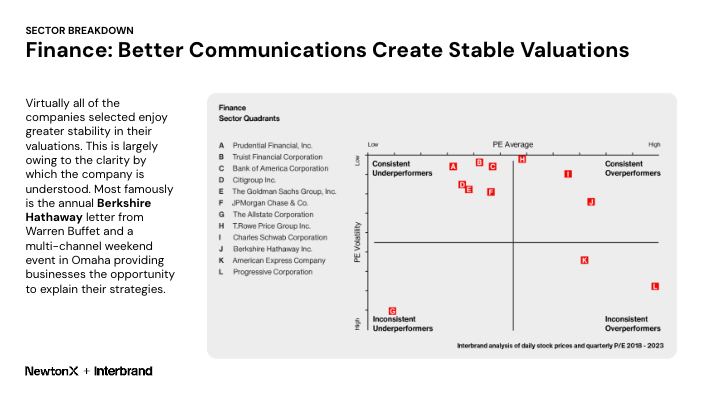

Whereas in finance, we see how better communications create stable valuations.

This is largely owing to the clarity by which the company is understood – they’re pressed into it due to regulatory requirements. Most famously is the annual Berkshire Hathaway letter from Warren Buffet and a multi-channel weekend event in Omaha providing businesses the opportunity to explain their strategies.

A disconnect exists between the brand’s performance and the investor community’s analysis of the brand. And not only did we uncover that analysts don’t get it, but investor relations don’t get it either.

But we needed custom research in order to crystalize our findings. That’s when I thought of NewtonX. Their work was going to be the advocate for brand management at the water’s edge of investor relations.

Going to pass it to Jackie to talk about the work that they did.

Jackie: Thanks Greg. I’ll first explain how our process works because that will help everyone better understand the findings.

Our unique process, called custom recruiting, which I’m going to walk through, is what allowed us to become the leader in B2B research. NewtonX built its entire business around doing B2B better than anyone else. This means for our clients we’re able to deliver really high quality data that lets them sleep the night before their presentations.

- Search

- The first step where we take apart your question or business challenge and break it into an audience.

- Imagine google with 40 advanced search fields, all for a person’s professional knowledge. We create a custom search in our proprietary technology, the NewtonX Graph, which delivers a list of professionals that meet the criteria.

- First time clients are often surprised how detailed we want to get – company size, seniority, geography, even titles.

- Recruit

- Next our team quickly ramps targeted outreach, creating personalized messages with incentives worthy of that professional’s time. You can’t get a CFO to take a survey for $5.

- We also develop a custom channel strategy – different markets and types of workers use different tools and watering holes. For example, we can’t use the same methods to contact blue collar workers as we do for content creators or the investor community.

- Verify

- We provide 100% verification for every one of our professionals. Before someone can enter a survey, our technology facilitates a unique two-step verification process to ensure they are who they say they are.

- Deliver

- Our in-house team of analysts and consultants deliver real-time intel, raw data files, and in some cases, an Management Consulting style analysis and reports with actionable takeaways.

Greg: From my perspective, this is what struck me about how NewtonX could help us. There were 3 things:

- The concept behind our research is the most powerful thing we know. It starts with their Knowledge Graph, that drives how they recruit and find targets. It’s not a professional’s title or label that makes someone a valuable respondent; it’s their knowledge.

- It’s also reach. Reach is especially valuable in B2B because it’s so hard to get the right person.

- I also appreciate how NewtonX is a strategic thought partner, not a list provider. We needed someone to understand the complexities and nuance of the story we’re telling. NewtonX meets our depth there because they have a consulting perspective embedded in our culture. For example, they’d be doing back of envelope math on calls – You don’t get that sense checking from a lot of vendors. You rarely get it at all. The value of our service is exponentially higher because of our thought partnership.

Jackie: Thanks, Greg. Appreciate sharing that from your perspective. Sometimes that’s the most powerful thing to hear.

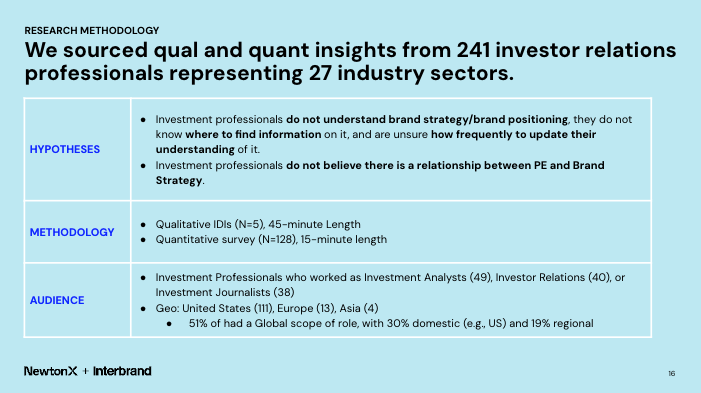

For our insights friends on the call, this format probably looks familiar…it’s usually how a project starts, with specs.

Our research sought to get to the bottom of these two questions: Essentially, Interbrand is seeking to understand and measure a potential disconnect between brand and the investor community.

How we arrived at our methodology is actually a good story…

- So when it came to getting into it with Greg and the IB team, we explained we couldn’t just ask the questions in a straightforward manner because they might invite a biased response.

- There’s also a vernacular to the investor community we needed to get right when designing a survey for them.

- To address this our strategist Ben suggested we run a few qual calls first and include a new audience, Investor Relations – who have some responsibility for packaging brand for the investor community, in addition to Financial Journalists and Investment Analysts who have an influence on share price.

So back to what Greg was saying on being a thought partner, we all agreed we needed the third audience and wanted to run Qual first to really get it right.

So let’s unpack this 76% stat from the beginning:

On the left, Brand was recognized as the second most important consideration to valuation by this sample of analysts and journalists, falling only behind financial forecast. That surprised us.

On the right, this audience agrees brand impacts valuation.

Everyone agrees it has an impact.

However, understanding of brand is low among Analysts and Journalists, and IR knows it!

On the left just 10% of surveyed analysts and journalists saying that they have a deep understanding of the positioning and strategy of the companies in their portfolio.

On the right is the IR saying, yeah, they probably don’t understand it very well.

Most companies are not getting full credit for their branding efforts as part of investment community valuations.

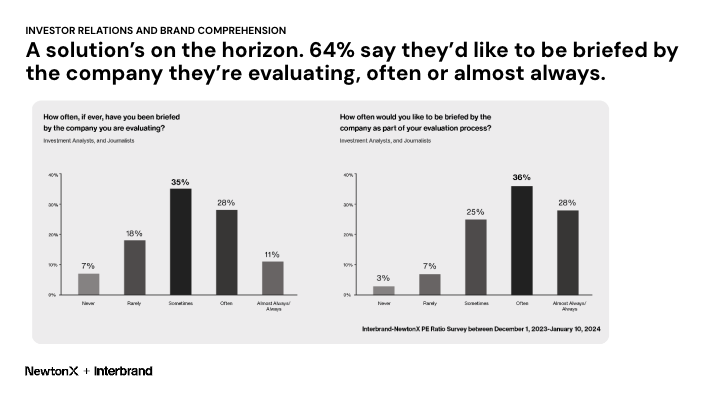

But a solution’s on the horizon. They are seeking to learn more. While less than half of analysts and journalists said that they often or almost always receive a briefing from the company they’re evaluating, 64% said they would like to be briefed more often than they are today.

Greg: We’ve identified the current shortcomings and disconnect between share price and understanding of brand strategy, but how do we bridge the gap?

There are four key steps that create a basis for improvement:

1. Develop a brand valuation model

Showing how brand strength, role of brand and financial performance work together, a brand valuation model helps strengthen understanding of how well a brand is working to deliver shareholder returns.

2. Conduct financial community research

Develop a foundational understanding of how the investment community currently perceives your brand. How aligned are these perceptions with the actual brand—and what differences are the most detrimental to your valuation?

3. Analyze communication effectiveness

Conduct a review of your current investor relations and public relations plans to determine which of your touchpoints and assets need to be improved. This can range from incremental change to a true transformation. We partner here with Brodeur Partners.

4. Revise your brand strategy

Determine what isn’t working for your brand in order to change perceptions. This will help build an understanding of what drives performance and where your brand strategy can be strengthened. As the strategy evolves, the team will need to provide continuous updates to continually shift perceptions in your brand’s favor.

As simple as it sounds, this problem is real for every public company.

What we’ve learned at Interbrand is – data alone isn’t good enough. Age of marketing impressions and brand health is done. It’s not about marketing outcomes, or customer service outcomes—it’s about business outcomes. Connecting to the CEO and CFO and asking.

Asking – hey, I think our brand might be undervalued. Elevate that to the most senior marketing stakeholder.

Then ask – What can we do about it? As we’ve demonstrated, it takes research, higher quality sample, and strategic thinking to get there.

As for 3 things you can do:

- Download the report, How Brand Impacts Share Price

- Talk to your boss: “Hey, I think our brand might be undervalued. But I heard an idea where research can change that, and I think we should pursue it.”

- Talk to Interbrand / NewtonX

Thanks everyone for joining. With that, we’ll open it up for Q&A.

Sign up for our newsletter, NewtonX Insights:

Related Content

[Webinar Recap] Building Strategic Research Partnerships: How Microsoft and NewtonX Source Critical Business Insights

NewtonX and Microsoft share 4 takeaways to drive research success through collaborative client-vendor partnerships.

read more[Webinar] How R/GA and Landor & Fitch Build Responsive B2B Research Stacks to Win Business

How R/GA and Landor & Fitch Build Responsive B2B Research Stacks to Win Business

read more[Webinar] Is an MROC right for you? 3 use cases that are perfect for research communities

NewtonX Sr. Product Marketing Manager Jimmy Coonan and Fuel Cycle VP, Research Science Kevin Row share best practices on running MROCs and how they fit into your research.

read more

[Report] How Brand Impacts Share Price

Interbrand, NewtonX, and Brodeur Partners reveal how brand research and investor communications can improve company valuation.

read moreHow Interbrand unlocked market capitalization with brand research

67% of S&P 500 companies may be inaccurately valued due to brand understanding. For enterprise research leaders looking to influence C-suite strategy, realigning investor understanding of your brand can help.

read more

New Research from Material and NewtonX Reveals Shifts in Digital Ad Spending and Social Media Strategies

New insights show how advertisers and agencies are succeeding and spending in an era of advertising targeting, social media and AI.

read moreBeyond the Deal: Why Brand Migration Makes or Breaks M&A

Only 7% of executives are fully satisfied with brand migration in M&A. Ogilvy & NewtonX reveal insights to drive post-deal growth.

read more