Get an inside look at how insights and strategy leaders at The New York Times and DoorDash build influence and deliver business impact.

Tim Bruno, NewtonX CRO

Hi, everyone. Thanks for joining us. I’m Tim Bruno, CRO at NewtonX. If NewtonX is new to you, we are the leading market research company for B2B insights. We built the most sophisticated algorithm in the industry to scan 1.1 billion professionals to connect you to the exact experts to answer your most pressing business challenges.

I lead our client team and I live right here in Denver.

B2B is a tricky thing, and the best way we can all learn is from hearing success stories. With that, I am very excited to be here with Jordan & Santiago, who come from companies that often arrive at your front door. I’ll pass it to Jordan to introduce yourself.

Jordan Jones, Associate Director of Cultural Insights, New York Times Advertising

I’m Jordan Jones, the Associate Director of Cultural Insights at New York Times Advertising. I lead Pivotal, an ongoing thought leadership program designed for clients seeking cultural relevance and consumer insight on the most important topics of today.

Santiago Sanchez, General Manager, DoorDash

I’m Santiago Sanchez, the General Manager of the Florida/Puerto Rico region at DoorDash. I lead a handful of strategic projects for the company to identify innovative avenues of value-creation for internal and external stakeholders.

Tim Bruno

I’m excited to have you on a stage together, because Jordan, you work in insights and Santiago, you work in strategy. It’s interesting to think about how the two sides approach the same challenge of insights.

Can you tell us about the role that research plays in your business unit? How does it create value?

Santiago Sanchez

Thanks, Tim. On my team at Doordash, we’ve only recently started using external research. When I joined, I wanted to bring more rigor and method to our decision making process. We use research to balance two forces that at times compete against each other: (i) sustain hypergrowth and speed of execution and (ii) confidence in answering the where, when, why, and how we want to compete.

Because when we go too fast – we miss things if we don’t dig into research and surface new insights. I need to say with a reasonable degree of confidence when I present to leadership, “here’s our recommendation, and here’s why we should do it.” Research helps us maintain or increase the upside by uncovering new growth ops and minimizes the risk by providing the ‘right’ certainty in our decisions.

Jordan Jones

At advertising insights at The Times, my role is research driven and sales adjacent. For example, my biggest ongoing project is Pivotal, where we do a deep dive on a given industry/topic and develop it into a cohesive, very design-forward narrative utilizing qual and quant methods. We bring these narratives to a client to help them better understand how they can use the larger suite of NYT offerings. For example, we can say to a healthcare client, “Here’s a deep dive on what healthcare readers are interested in, and here’s how it can live across our portfolio – whether news, food, games, and more.”

At our best, we bring an intriguing piece of thought leadership to our clients that is incredibly engaging and of the highest quality possible. One of my favorite quotes from a sales rep is: “This product helps us show up in a way that’s worthy of the NYT.”

Tim Bruno

I like how you both reference the idea of data you can stand behind. That’s why NewtonX was founded. We do the hard work of getting that data to you so our clients can focus on decision making, and collaborating with their internal stakeholders. Now I’m curious to hear –

Tell us about a time you faced an obstacle in connecting insights to business impact.

Jordan Jones

Answering the “so what?” for clients and not just presenting nicely designed findings. Research has to support the strategic goals of the company. From when I first started at The Times, my understanding of our strategy has evolved tremendously. We have to ask ourselves: How does research actually get back to what we’re trying to do? Not just research for research sake.

For example, we were working on a healthcare project, which was ultimately successful, but the client was very interested in understanding real-world takeaways and applications from our data. Our team is very conscious of including real world examples of how a theme relates to The Times offerings.

The Times offers more than breaking news. One of our larger goals is to shine a light on all the pieces of The Times portfolio such as Games (Wordle) to Cooking to Wirecutter and The Athletic. In our research, no matter what the topic is, we want to make sure we are giving some attention to all that The Times has to offer and we want to develop our understanding of our individual offerings and how our readers interact with them.

Santiago Sanchez

I have a similar story to Jordan. I recently had a meeting with our senior stakeholders where we gave them insights based on the research intel we got. It was one of the first times where I’ve been picked and prodded, and the team had an answer for all the questions and the data to substantiate the answers.

Strategy before research looked like: Go with your business sense. Then gut check that sense with a few data points and GO. It was very much a “build the plane as you fly it” mentality.

But now that the macro, competitive and geopolitical landscapes are in flux – we need to grow in a more disciplined way. I liken working at DoorDash to being a teenager growing into an adult. You want to keep that jovial spring in your step, but you also have new and more responsibilities and need to step up your processes.

Strategy after research looks like: In a nutshell, we have a tighter focus to our conversations, ultimately giving us more time to go deeper on more impactful topics. Insteading of scraping the surface on 20 things, we can go deeper on the 2 or 3 topics that research suggests we focus on. Out of a 180 degree panoramic review, we focus on these 10 degrees. We can narrow the conversation based on the hypotheses we develop with our research partners like NewtonX.

Tim Bruno

Love that. We hear from clients that one of the biggest advantages of working with us is simply that they can do less research, and focus on decisions. Our strongest partnerships are rooted in being extensions of our clients’ teams and responding to whatever degree of support the business needs. To my next question:

What makes for a successful leader in your role?

Interested to hear your perspectives since Jordan’s formally in research while Santiago’s in strategy.

Jordan Jones

At The Times, it’s also about building influence & relationships with internal stakeholders to extend the impact of our work.

It’s important for insights to be celebrated internally as well as externally. If we get a sale, that’s great, but we’re a large org and our data could be used by many others. We need to build relationships with audience strategists and people who put together proposals.

We don’t want insights to be like something you watched – and then you turn off the TV and that’s it. We want our work to be a series that stakeholders are excited about, not just one episode.

To this end, we’ve created regular share outs of our work, like lunch and learns. We reach out to other teams. For example, we have strong audience segmentation capabilities. Sometimes we’ll put together a report and work with our data team to create a bespoke audience segment.

We also utilize our strong internal comms system at the Times and promote insights in company wide newsletters and exclusive slack channels. Taking advantage of these channels has proven valuable for all involved.

Santiago Sanchez

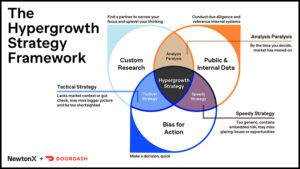

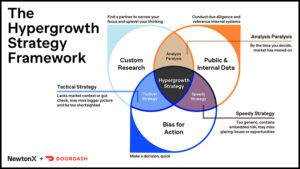

It’s not a one-size fits all, but I’ll give you some perspective on how I have seen successful leaders create value on and off the court. It’s all about balancing data conviction/analysis and speed. We all want to get as much conviction in our business decisions, but it’s easy to get too fixated on the research and the data and forget about the decision. Successful business leaders understand that research is a means to an end, not the end itself.

The 99/1 Approach: By the time you have full conviction in a decision, it’s too late. The market’s already moved without you. You need to be able to take calculated risks to avoid getting analysis paralysis. Purposeful and creative research helps leverage multiple channels to get data and know ‘how much data is enough data’ for me to give the OK GO.

The 20/80 Approach: You go with your gut, and keep research to a minimum. You have (what you think) is a good idea and you are eager to go out and execute. You need to be careful not to get yourself in an endless loop of experimentation with no material results or scale.

We made a strategy framework around this that you can pick up at the NewtonX booth – I’ll also be around the booth after our talk for anyone who wants to chat more.

Download the framework here.

Tim Bruno

And that’s a wrap. Thanks both for your time and partnership.